Navigating the complexities of finance is crucial in today's rapidly evolving economic landscape. This comprehensive guide is designed to provide insights and strategies across various facets of finance, tailored for both the novice and the seasoned financial enthusiast.

We'll delve into personal financial management, explore market trends, discuss comprehensive financial planning, and examine the impact of technological advancements in finance. Our aim is to empower you with the knowledge and tools necessary to make informed decisions and achieve financial success.

Building a Strong Foundation

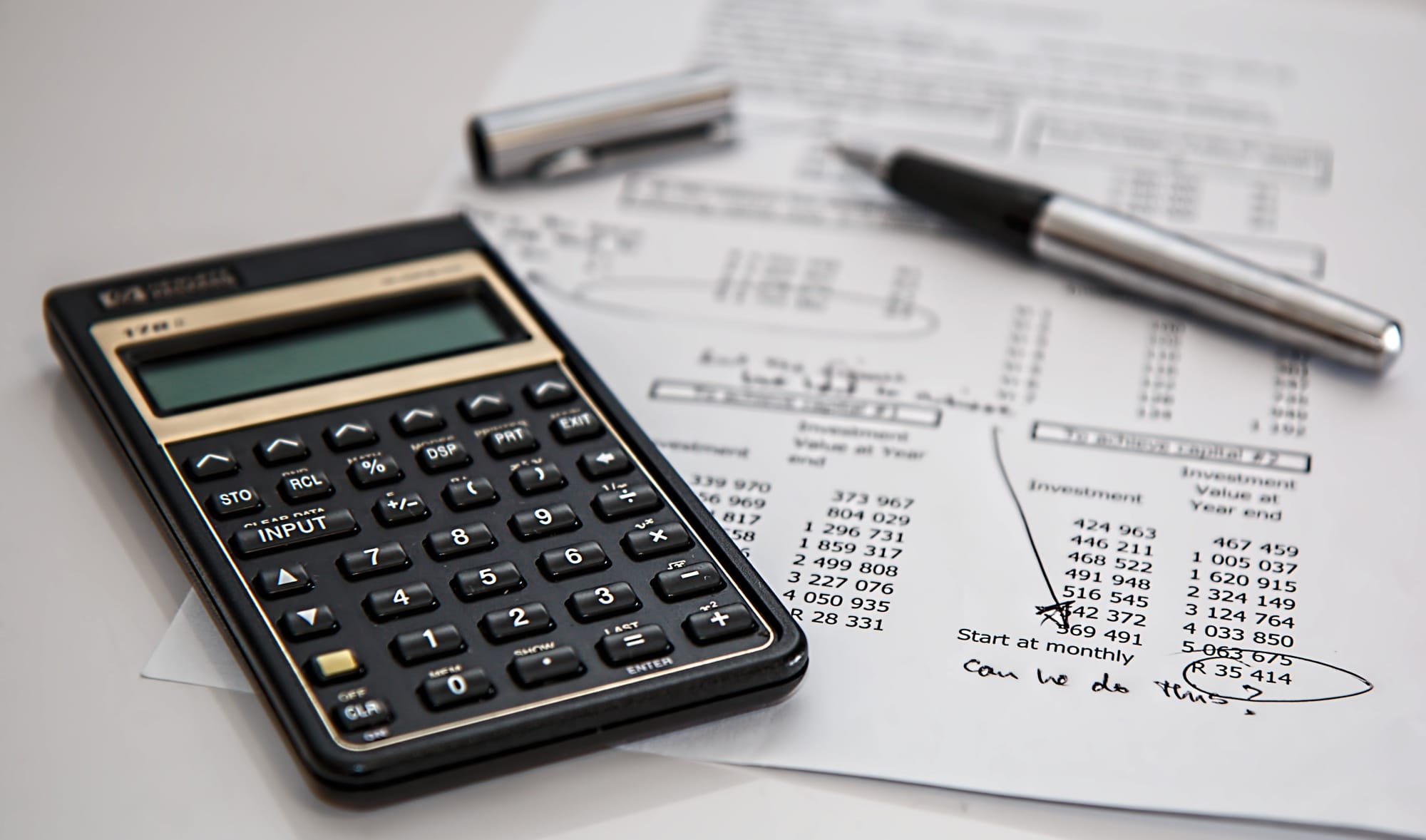

The cornerstone of personal finance lies in effective budgeting and saving. Understanding your income and expenses is the first step towards financial stability. Creating a budget helps you track your spending, identify unnecessary expenses, and redirect funds towards saving. Emphasizing the importance of an emergency fund and saving for future goals, this approach lays the groundwork for a secure financial future.

Investing is a vital component of personal finance, offering the potential for your money to grow. We discuss various investment options, from stocks and bonds to mutual funds and real estate, and how to choose the right mix based on your risk tolerance and financial goals. Equally important is the management of debt, where we explore strategies to tackle debts, from high-interest loans to credit cards, ensuring they don't impede your financial objectives.

Navigating the Investment Maze

The financial markets are a melting pot of opportunities, but navigating them requires an understanding of their dynamics. We cover the basics of stock market operations, how to interpret market trends, and the significance of economic indicators in investment decision-making. This knowledge is crucial for anyone looking to invest in the stock market or other financial instruments.

An essential aspect of investing is managing risk. This section delves into the importance of diversification in your investment portfolio, how to balance risk and return, and the role of different asset classes in achieving this balance. We also discuss the impact of global events on markets and how to adapt your investment strategy in response to these changes.

A Roadmap for the Future

Effective financial planning starts with setting clear, achievable goals. We emphasize the importance of identifying short-term and long-term financial objectives, from buying a home to saving for retirement. This process involves assessing your current financial situation, understanding your future needs, and creating a plan to bridge the gap.

Financial planning isn't just about numbers; it's about preparing for life's significant milestones. This includes strategies for funding your children's education, planning for retirement, dealing with healthcare costs, and understanding the implications of major life events like marriage or career changes on your financial plan.

"Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble."

Warren Buffett

Embracing the Financial Revolution

The fintech revolution has transformed traditional banking and payment systems. We explore the rise of digital banking, including online banks and mobile banking apps, and how they offer convenience and enhanced features. The evolution of payment systems, from digital wallets to contactless payments, is also covered, highlighting how technology is making financial transactions faster and more secure.

Perhaps the most groundbreaking aspect of fintech is the development of blockchain technology and cryptocurrencies. This section provides an overview of how blockchain works and its implications for the financial world. We also demystify cryptocurrencies, discussing their potential as an investment, the risks involved, and their future in the financial landscape.

The world of finance is rich and complex, offering a plethora of opportunities for personal growth and financial success. By mastering the art of personal finance, staying abreast of market trends, planning strategically for the future, and embracing the advancements in fintech, you can confidently navigate this landscape.

Remember, financial success is a journey of continuous learning and adaptation. Armed with the insights from this guide and a commitment to proactive financial management, you are well on your way to achieving lasting financial stability and growth.

Comments